The Medicare Access and CHIP Reauthorization Act (MACRA) legislation is fundamentally changing the way Medicare pays clinicians. Understanding this complex new payment program and developing a successful strategy is challenging for many health care organizations, clinicians and staff in Kentucky and across the US.

The Kentucky REC offers a variety of grant funded and fee-for-service options tailored to the needs of our clients. Click on the boxes and links below or contact us to find out how we can help your organization master the Quality Payment Program.

The Basics of MACRA

Passed in April 2015, MACRA gave the Centers for Medicare and Medicaid Services (CMS) the authority to create the Quality Payment Program or QPP. The QPP replaced the Sustainable Growth Rate (SGR) cuts with an alternative set of payment policies governing Medicare payments to eligible clinicians. The goal is to move Medicare spending increasingly toward rewarding higher quality and value and away from financial incentives for the volume of services provided.

Eligible clinicians must choose between two tracks: the Merit-Based Incentive Payment System (MIPS), or participation in an Advanced Alternative Payment Model (APM). This choice determines Medicare Physician Fee Schedule reimbursement rates and methods beginning January 1, 2019.

MACRA creates the Quality Payment Program (QPP) with two main tracks:

- Advanced Alternative Payment Models (APM)

- Merit-Based Incentive Payment System (MIPS)

Value-based Payment Individualized Assistance

Support for healthcare providers as they navigate the changes under MACRA and Value-Based Payment through personalized education, in-depth gap analysis, action plan, monthly meetings, and attestation support.

Quality Payment Program—Small, Underserved and Rural

Free Quality Payment Program technical assistance for small, underserved, and rural practices of 15 clinicians or less through a CMS contract establishing the QPP Resource Center™, which provides education, resources, tools, live chat and phone support.

Quality Improvement

Guidance, support and tools are available for practices interested in improving their performance on measures of quality & value.

MACRA Quality Payment Program Timeline

2017

Jan 2017—

Dec 2017

*PY1: 3 pts & -/+4%

2018

Jan 2018—

Dec 2018

*PY2: 15 pts & -/+5%

2019

Jan 2019—

Dec 2019

*PY3: 30 pts & -/+7%

2020

Jan 2020—

Dec 2020

*PY4: 45 pts & -/+9%

2021

Jan 2021—

Dec 2021

*PY5: 60 pts & -/+9%

2022

Jan 2022—

Dec 2022

*PY6: TBD & -/+9%

2017

Jan 2017—

Dec 2017

*PY1: 3 pts & -/+4%

2018

Jan 2018—

Dec 2018

*PY2: 15 pts & -/+5%

2019

Jan 2019—

Dec 2019

*PY3: 30 pts & -/+7%

2020

Jan 2020—

Dec 2020

*PY4: 45 pts & -/+9%

2021

Jan 2021—

Dec 2021

*PY5: 60 pts & -/+9%

2022

Jan 2022—

Dec 2022

*PY6: TBD & -/+9%

2017

Jan 2017—

Dec 2017

*PY1: 3 pts & -/+4%

2018

Jan 2018—

Dec 2018

*PY2: 15 pts & -/+5%

2019

Jan 2019—

Dec 2019

*PY3: 30 pts & -/+7%

2020

Jan 2020—

Dec 2020

*PY4: 45 pts & -/+9%

2021

Jan 2021—

Dec 2021

*PY5: 60 pts & -/+9%

2022

Jan 2022—

Dec 2022

*PY6: TBD & -/+9%

*PY#: Threshold to avoid penalty & Potential Payment Adjustment

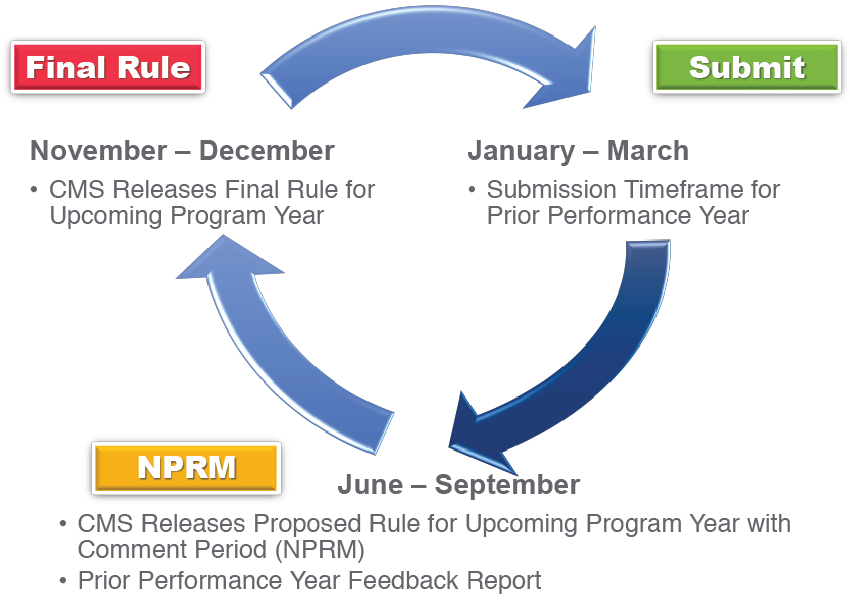

Quality Payment Program Annual Lifecycle

January 1st — December 31st